The clock is ticking for homeowners and businesses who want to take advantage of one of the biggest financial incentives for clean energy. The Federal Solar Investment Tax Credit (ITC), which currently covers 30% of the total cost of solar and battery installations, is set to expire in December 2025. That means you have a limited window to install solar panels and energy storage systems while maximizing your savings.

At CalPacific Power, we want to make this opportunity even more valuable. For a limited time, we are offering an exclusive 5% discount on solar and battery installations. When combined with the federal incentive, this can translate into thousands of dollars in savings.

In this article, we’ll explain how the tax credit works, why it’s ending, and why acting now is the smartest move for California homeowners and businesses.

What is the Federal Solar Tax Credit?

The Federal Solar Tax Credit, officially known as the Investment Tax Credit (ITC), is one of the most impactful programs ever created to encourage renewable energy adoption. It allows you to deduct 30% of the total cost of your solar panel and battery installation from your federal taxes.

This includes:

- Solar panels

- Inverters and racking systems

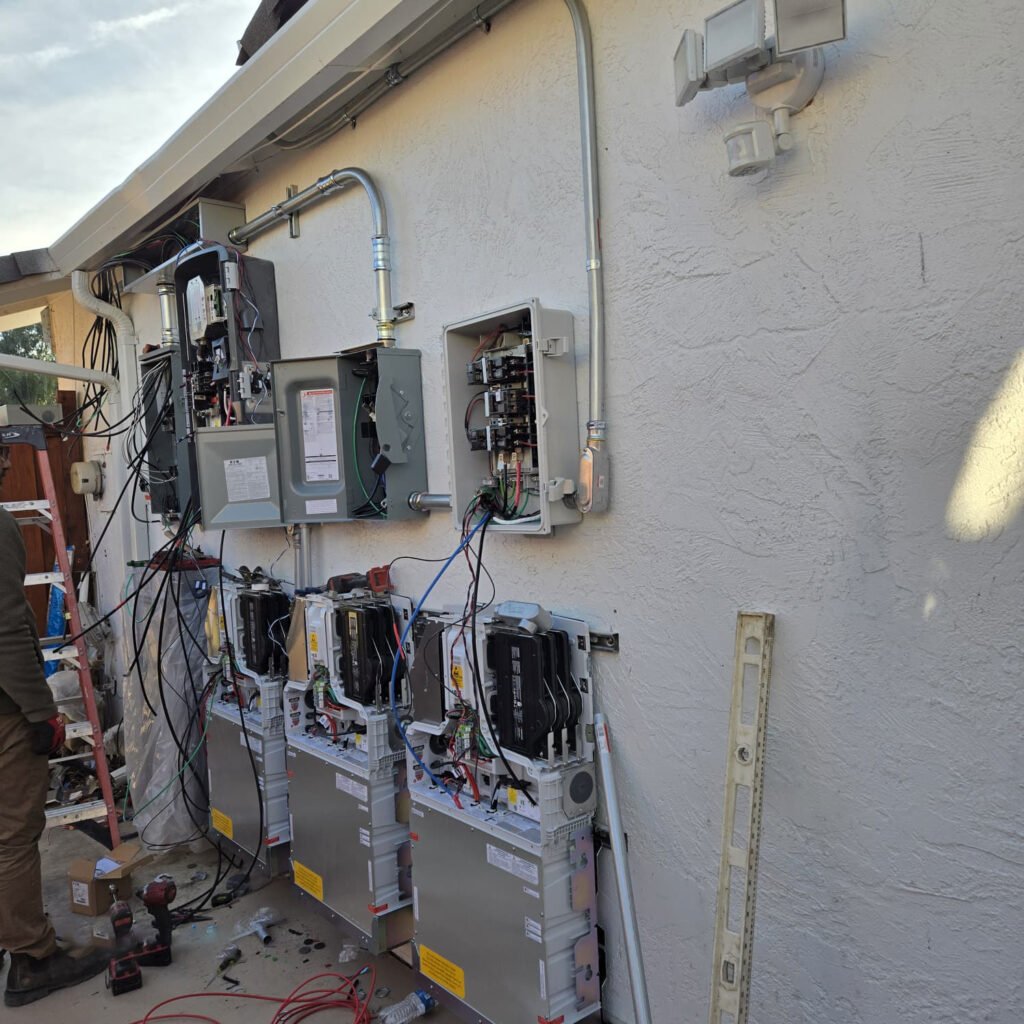

- Batteries such as the Tesla Powerwall or Enphase storage

- Electrical upgrades and labor costs

Example: If your solar + battery system costs $30,000, the ITC lets you deduct $9,000 from your federal taxes. That’s money back in your pocket.

Since its introduction, the ITC has saved American homeowners and businesses billions of dollars while accelerating the shift to clean energy.

When Does the Solar Tax Credit Expire?

The ITC is scheduled to end after December 31, 2025. Unless Congress decides to extend it again, this will be the last chance to secure the 30% savings.

Why does this matter? Because as the deadline gets closer, demand for solar and battery installations is expected to skyrocket. Contractors will book out months in advance, and equipment supply may become limited. If you wait until the last minute, you may miss out on the incentive altogether.

Why You Should Act Now

There are several compelling reasons why 2024–2025 is the best time to go solar:

1. Maximize Your Savings

With both the federal ITC and CalPacific Power’s 5% discount, you can save more than at any other time. A $30,000 system, for example, could bring $10,500 in combined savings when you stack both offers.

2. Beat Rising Energy Costs

California electricity rates are among the highest in the country and continue to rise each year. By generating your own clean power, you lock in lower energy costs for decades.

3. Energy Independence and Reliability

Power outages and grid instability are common in California. With solar panels and a battery system, you can keep your home or business powered 24/7, even during blackouts.

4. Increase Property Value

Homes with solar and storage are more attractive to buyers, often selling faster and at higher values. Installing now not only saves money but also boosts your long-term investment.

5. Limited Installation Capacity

As 2025 approaches, installers across the state will become overwhelmed with demand. Acting early ensures you secure your spot and get your system running before the deadline.

CalPacific Power’s Exclusive 5% Discount

To help more families and businesses go solar before the ITC ends, CalPacific Power is offering a 5% discount on all solar and battery installations.

This discount is available only for a limited time and applies to complete systems that include both solar panels and energy storage.

Here’s how it adds up:

- $30,000 solar + battery system

- Federal ITC (30%) = $9,000 savings

- CalPacific Power discount (5%) = $1,500 savings

- Total Savings = $10,500

That’s over ten thousand dollars you can keep in your pocket, while enjoying clean, reliable energy for decades to come.

How to Take Advantage Before It’s Too Late

Getting started with solar and battery installation is easier than you might think. At CalPacific Power, we’ve streamlined the process into three simple steps.

1. Free Consultation & Energy Analysis

We’ll review your energy usage, roof layout, and electrical needs to determine the best solar + battery system for your home or business.

2. Custom Design & Transparent Proposal

Our team designs a system tailored to your property and provides a clear, detailed proposal showing your costs, savings, and timeline.

3. Professional Installation & Support

Once you approve, our licensed experts handle everything — permits, installation, inspections, and monitoring. We also provide ongoing support and maintenance for peace of mind.

With our certifications from Tesla, Enphase, and Schneider, you can be confident you’re getting industry-leading technology and professional service.

Frequently Asked Questions

Do I qualify for the Federal Tax Credit?

A: Yes, as long as you install solar panels or batteries on a property you own before December 31, 2025. Both residential and commercial installations are eligible.

Can I combine the tax credit with CalPacific’s 5% discount?

A: Absolutely. The federal ITC applies to your total system cost, and our discount reduces that cost even further.

What if I already have solar?

A: You can still qualify for the ITC when adding battery storage to your system.

How long does installation take?

A: Most projects are completed in 1–2 months, but demand is rising fast. Scheduling early ensures your project is completed before the deadline.

Final Thoughts: Don’t Miss This Last Big Chance

The federal solar tax credit has made clean energy affordable for millions of Americans. But with the program ending in December 2025, the window of opportunity is closing.

By acting now, you can:

- Save 30% through the federal tax credit

- Save an additional 5% with CalPacific Power’s exclusive discount

- Protect yourself from rising energy bills and power outages

- Increase your property value and secure long-term savings

Don’t wait until it’s too late. Contact CalPacific Power today to schedule your free consultation and lock in your savings before the federal solar tax credit disappears for good.